What is GiniMachine?

GiniMachine is a no-code AI decision-making platform that provides software for business predictions. It uses automated decision-making algorithms to predict and manage credit risks, improve credit portfolios, predict churn, retain customers, and analyze data insights. It provides solutions for credit risk management, credit scoring, application scoring, collection scoring, and predictive analytics.

How does GiniMachine work with raw or structured data?

GiniMachine works with both raw and structured historical data. It has the ability to prioritize certain fields and process datasets even if some data is missing. It can handle large amounts of information and is efficient at identifying patterns and making predictions from this data.

How much data can GiniMachine process?

GiniMachine can process terabytes of historical data. There's no limit to the number of records it can handle.

What types of risk models does GiniMachine build?

GiniMachine builds risk models to manage and predict credit risks, customer retention, churn rates, etc. These models are high-performing and are used for making informed and balanced decisions.

How beneficial is GiniMachine for credit risk management?

GiniMachine, by providing dedicated decision-making software, is highly beneficial for credit risk management. It allows businesses to identify creditworthy borrowers in different industries, prioritize debtors with a higher chance of fast payback, and to build, validate, and deploy risk models swiftly.

How efficient is GiniMachine's solution for collection scoring?

GiniMachine provides an efficient solution for collection scoring by prioritizing debtors with a higher chance for quick payback. It offers accurate predictions to optimize communication tools for recovery process, consequently improving productivity while avoiding the waste of resources on non-performing debts.

How does GiniMachine's application scoring work?

GiniMachine simplifies application scoring by working with massive amounts of data to identify creditworthy borrowers across industries. Using historical data of a business, it can increase return rates in online loans, auto finance, POS lending, and more.

How does GiniMachine improve traditional credit scoring?

Traditional credit scoring is enhanced by GiniMachine's top-notch machine learning solutions, which manage to mitigate the downsides commonly associated with traditional approaches. With its help, lenders can grant loans to borrowers with minimal credit history (thin-file borrowers) and find an optimum balance between profit and risks involved.

Can GiniMachine work without preliminary data preparation?

Yes, GiniMachine can work without preliminary data preparation. It requires minimum 1,000 records with maximum details and a binary status to build a model.

How does GiniMachine help banks?

GiniMachine offers decision-making Software as a Service for banks. With this, risk managers can get a full picture with no specific expertise in data science or machine learning. It also gives them access to highly technological risk management, allowing models to be built in just a single click.

How do GiniMachine's predictive analytics work?

GiniMachine's predictive analytics offer an automated decision-making platform which does a huge preparatory job. It builds, validates, and deploys models that are well-equipped for risk management calculations and real-time predictions.

How does GiniMachine benefit financial services?

GiniMachine benefits financial services by delivering reliable insights and high-performing risk and credit scoring models. It uses artificial intelligence to suggest decisions that can be fine-tuned to minimize risks, efforts, and time expenditures.

What does GiniMachine's decision-making platform offer?

GiniMachine's decision-making platform offers a solution that helps businesses predict and reduce risks, improve credit portfolios, predict churn rates, retain customers, and extract value from data insights. The platform is designed for processing large volumes of data and generating high-performance risk models.

Does GiniMachine offer a free trial?

Yes, GiniMachine offers a free 30-day trial for its users.

Can machine learning solutions from GiniMachine help with thin-file borrowers?

Yes, GiniMachine's machine learning solutions can assist with thin-file borrowers. Through its top-notch decision-making software, even borrowers with minimal credit history can be granted loans, enhancing financial inclusion and ensuring a balanced approach between risk and potential revenue.

What makes GiniMachine's interface friendly?

The friendly interface of GiniMachine is one of its key competitive advantages. It's designed for a great user experience and ease-of-navigation, thus making data processing and decision making more efficient and less time-consuming for businesses.

How does GiniMachine help in predicting churn and retaining customers?

GiniMachine assists in predicting churn and retaining customers by processing historical data and predicting future behavior. This enables businesses to proactively engage with customers, increasing retention rates and improving their credit portfolio.

In what way does GiniMachine reveal value of data insights?

Through its predictive analytics, GiniMachine helps to reveal the value of data insights. It simulates, compares, and fuels business decisions based on AI decision-making algorithms. This ultimately provides businesses with a greater understanding of their data, which is key for strategic decision-making.

What is the approach of GiniMachine to risk management?

GiniMachine adopts a proactive approach towards risk management. It works with raw or structured historical data to build, validate, and deploy risk models in minutes, not days. It smartly prioritizes fields and processes datasets even with missing data, making risk management efficient and data-driven.

How does GiniMachine help in reducing risks?

GiniMachine's decision-making platform can help in reducing risks by up to 45%. This is done through the use of AI algorithms that process historical data to build and validate predictive models, which then help in risk management.

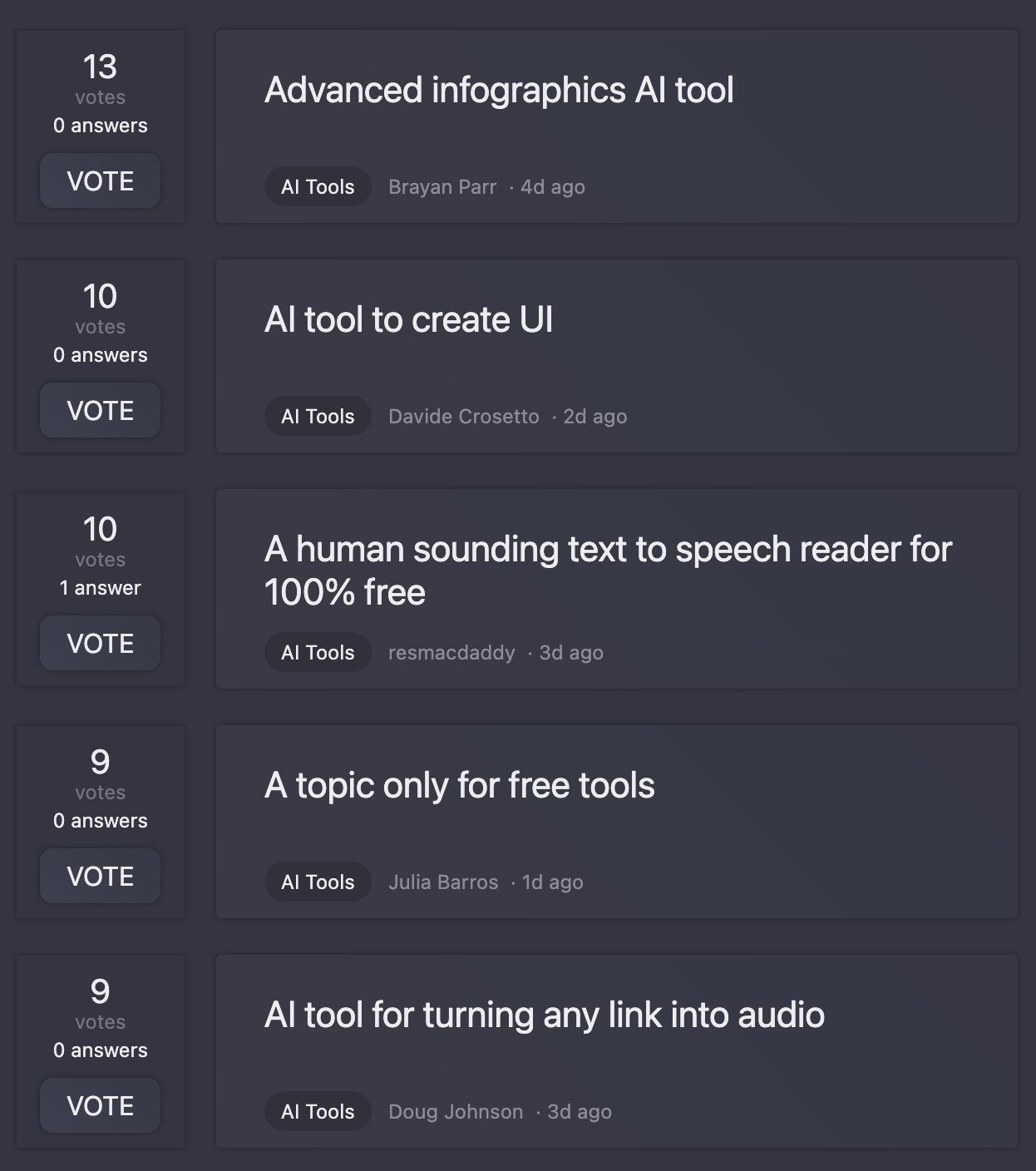

AI for financial data analysis and market insights.534

AI for financial data analysis and market insights.534 Making financial reports understandable for everyone.4120

Making financial reports understandable for everyone.4120 Aiding strategic analysis and KPI calculations with AI.415

Aiding strategic analysis and KPI calculations with AI.415 Expert data analyst for NRC IRAP funding insights.348

Expert data analyst for NRC IRAP funding insights.348 31K

31K 21K

21K 225

225 271

271 272

272 236

236 193

193 144

144 14

14 157

157 Providing financial market data including stocks, indexes, and options.18

Providing financial market data including stocks, indexes, and options.18 Expert in analyzing company filings for investment insights.146

Expert in analyzing company filings for investment insights.146 Analyzes financial data to drive business decisions.11

Analyzes financial data to drive business decisions.11